The Best Credit Card for Fuel in Singapore

What’s the best credit card for fuel purchases? Well, in this guide we’ll take you through the options so you’re in the know.

Plus, we’ll introduce you to business fuel cards, which you can also use to save money on your fuel expenses and simplify your fleet’s refuelling needs. Read on to find out more, or compare the market right now to sort a deal out.

Which credit card is best for fuel purchases?

The best credit card for fuel depends on your business’ needs, but most credit cards in Singapore will let you pay at the pump. Some providers may include deals to go with that, such as savings and other features, so check with a provider to see if there are other perks.

Otherwise, the credit card works as normal!

You pay for something, then you enter the PIN number at the till and you’re all good to go. Handy for drivers in your fleet and you can use it to keep track of refuelling costs.

What are fuel cards?

They’re a type of payment card specifically for refuelling, which lets drivers top up and then pay with the fuel card. They can’t use the card to buy anything else.

And that means they’re great for fleet managers and business owners, because you can use the cards to set spending budgets for fuel.

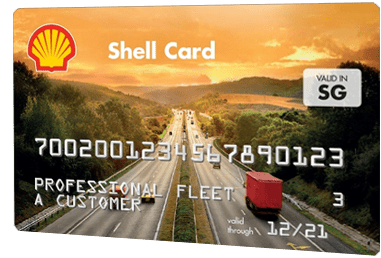

The best fuel card in Singapore

The Shell fuel card is an excellent choice for any business. The Shell card is good for use at 50 stations across Singapore. You get an online account with the card to keep track of all your fuel transactions.

The benefits of using this fuel card include:

- Cutting down on accounting with a monthly, or bi-monthly, fixed bill.

- Checking all transactions from a device of your choice.

- Secure PIN protected cards.

- Free smartphone app with your deal.

All you need to do to get your Shell fuel card is compare the market! You can find the right deal in seconds and start your online application.

Are fuel cards credit cards?

No, they’re not. Fuel cards only let you pay for fuel (whereas with credit cards a driver can buy anything) and a few other knickknacks from petrol stations.

Basically, fuel cards are mainly for fuel.

With a credit card, your drivers would be able to buy all sorts of other goods. If you want to control that spending, then these cards let you do just that.

What’s the best credit cards for fuel savings?

The best credit card for fuel savings is… a fuel card! And not a credit card. While they do simplify your refuelling needs, it’s only with a fuel card that your business benefit from long-term fuel savings.

With a fuel card you just pay as you go, which means you don’t have to concern yourself with credit card interest. You just pay at the station and reap the rewards!

The best credit card for fuel cashback

We get asked regularly about the best rewards program for customers when buying fuel with credit cards. And, again, your best bet is to get yourself the likes of a Shell fuel card.

With Shell, every time you refill you get precious Shell Driver Club points. These will accrue automatically over time and will make sure you’re gathering points, saving money and benefitting from the best refuelling strategy for your business.

The differences between credit cards and fuel cards

The main difference is fuel cards have discounts on fuel prices, but you can only really use it to buy fuel. However, you get total control of your fuel expenses. And with these cards it’s much easier to reclaim VAT!

On the flip side, with credit cards your employees can pay for anything. It simplifies your expenses, but at the same times opens up a lot of risky opportunities for fraud and controlling spending.

Anyway, we’ve broken the main differences into a list for you below. Starting with…

Fuel cards

- Discount fuel prices (depending on your provider).

- Better security and prevention of fuel fraud.

- No interest on purchases for up to three weeks.

- No need for receipts.

- Card management tools in an online portal.

- Keep track of filling patterns between drivers.

- Fleet efficiency reporting.

- Reduced internal administration costs.

- Some cards offer points/rewards scheme.

Credit cards

- Pay for fuel and other things, such as business trip items (hotels, drinks, food and much more)

- Employees can purchase almost anything they want (so, you’ll need a high level of trust there).

- Discounts on fuel prices aren’t available.

- Find fuel and non-fuel fraud is harder to spot and stop.

- APR rates vary. Plus, offers can change over time and interest is payable on your fuel purchases.

- You’ll need to keep track of all your receipts.

- Invoicing with VAT is a longer process.

- Some credit cards have a rewards scheme.

iCompario tip: Use telematics to lower your fuel expenses

If you want to use other tactics to monitor your fleet, and lower your fuel expenses, then you should also turn to vehicle telematics systems. With these systems, you can monitor your fleet in real-time with asset trackers and other software.

This keeps your fleet secure, can help you save fuel with better driving tactics and you’ll get instant alerts on any problems with your vehicles. Compare the market to find the right software for your fleet.

The benefits of fuel cards

Sure, you could use a standard credit card to handle your business’ fuel expenses. That’d get the job done. But with a fuel card for your drivers, you’ve got extra features that go a long way to saving you time and money.

Better card security

Fuel cards can only be used to buy fuel and are PIN protected. You can even set spending limits on individual cards.

Unlike with credit cards. If you lost that one, then someone could go off on a spending spree. But with your fuel card, you can put a stop to that rapidly for peace of mind.

Manage your fuel reports

Every transaction is tracked in your online account and you can print off reports to see all of your spending. This is great for admin purposes and puts your business in control of your monthly fuel expenditure.

Improve cashflow

You only pay bills on a fixed term basis making it much easier to manage your cashflow and budget properly. And that keeps costs down and accounts in order.

Set purchase restrictions

If you want to make sure drivers don’t go over a spending limit, you can set a restriction on individual drivers. Pretty handy if you want to stay on budget.

Convenient for drivers

Your drivers will also really appreciate fuel cards. They just make daily life easier as they don’t need to carry spare change around with them or keep track of receipts.

The convenience is just swiping a card and that’s it. They can focus on doing their job.

Compare the market for fuel cards

Okay, so you know the best credit card for fuel. But now it’s time to give fuel cards a try! All you need to do is compare the market to find the right provider for you here in Singapore. What you need to do is:

- Enter your business details.

- Let us search the market.

- Pick from our top recommendations.

Different providers offer different perks, so make sure you pick the one that best matches your business. It’ll save you time and money in the long-term.