Uninsured Driver Statistics Show Alarming Numbers of Motorists Driving Illegally

Concerning number of motorists caught driving without insurance

The UK is in the grip of an uninsured driver problem, new data covering the last four years has revealed one in 119 motorists have been caught driving without insurance, with some areas of the country over two times higher than the average figure.

Shockingly, this figure equates to 352,000 people have been convicted of driving without insurance in the past four years and the worrying fact is, the data only covers those that have been caught by the police, leading to fears that the rate is likely to be even higher.

We have used a Freedom of Information request to obtain data from the DVSA covering 2019-2023, to find out how many drivers have been caught driving without insurance by the police. The data gave us the number of drivers in each UK postcode that have had IN10 code applied to their licence. The IN10 offence is “Using a vehicle uninsured against third party risks”.

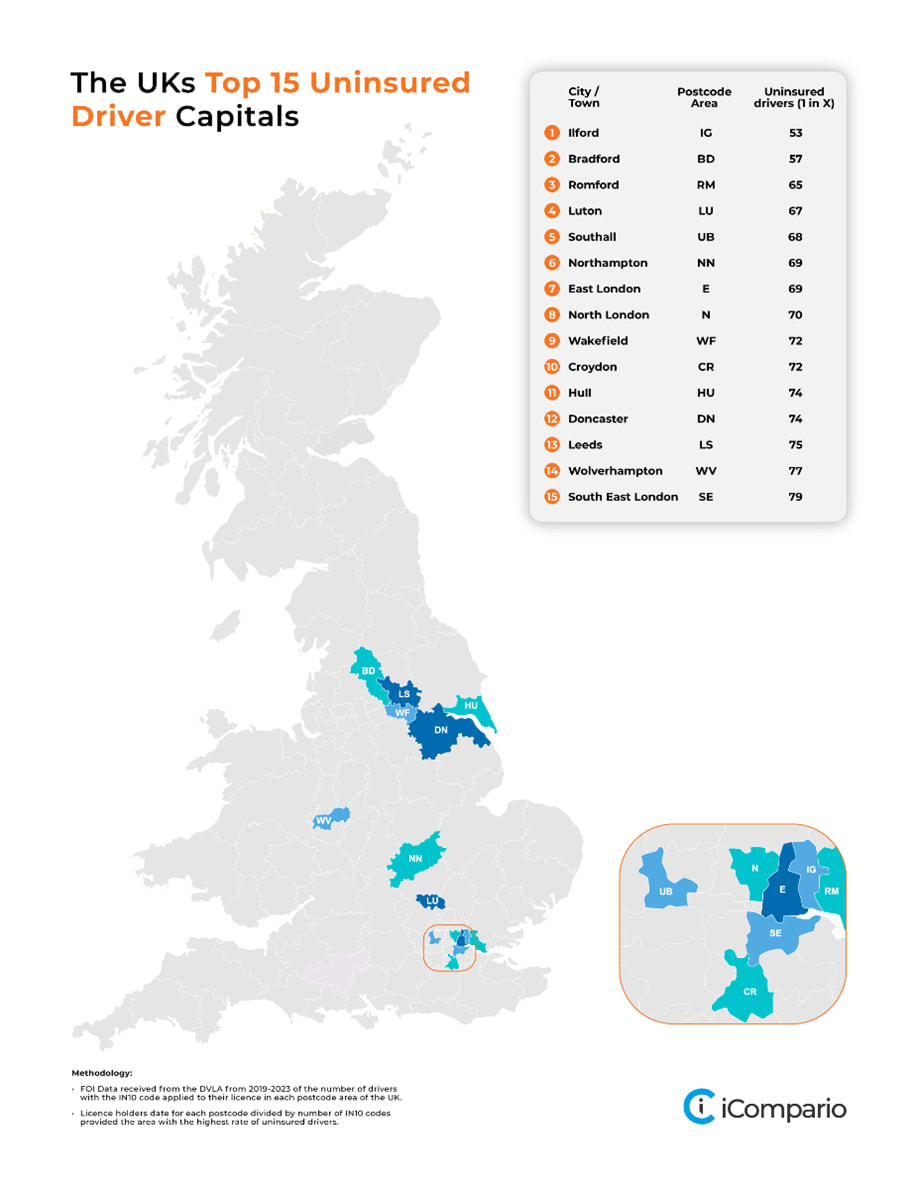

UK Uninsured Driver Hotspots

The FOI request we sent out to the DVSA covering 2019-2023 has enabled us to delve further into the extent of the nationwide problem of driving without insurance, as the authorities tell us how many drivers have been convicted in the past four years.

To calculate the uninsured driver hotspots in the country, we divided the number of licence holders in each postcode area by the number of licences with an IN10 code applied.

Our findings showed that England (one in 117) has a higher rate of convicted uninsured drivers than Wales (120) and Scotland (131).

According to the data, East London has a rife uninsured driver problem, with Ilford and Romford having one in 53 and one in 64 licence holders caught without insurance in the last four years, respectively.

The West Yorkshire city of Bradford splits the East London towns in the top three, with one in 57 drivers being convicted of driving without insurance.

Motherwell is the Scottish area with the highest rate of uninsured drivers (one in 110), while Cardiff is the Welsh area with the highest rate of uninsured drivers (one in 91)

Which areas in the UK are showing a rise in uninsured drivers?

There are no signs that the uninsured driver problem will be going away any time soon, with as 49 postcode areas in the UK have reported a year-on-year rise of uninsured driver convictions.

The top 10 areas on the rise for uninsured driver convictions, had at least a 12% year-on-year increase.

|

Postcode area |

YoY Increase in uninsured driver convictions |

| Torquay (TQ) | +35% |

| Northampton (NN) | +34% |

| Llandrindod Wells (LD) | +33% |

| Kilmarnock (KA) | +27% |

| Harrogate (HG) | +21% |

| Halifax (HX) | +21% |

| Blackburn (BB) | +19% |

| Guildford (GU) | +18% |

| Truro (TR) | +14% |

| Blackpool (FY) | +12% |

Torquay has reported the largest year-on-year rise in the country, with over a third more (35%) IN10 convictions.

Northampton in the Midlands (34%) and Llandrindod Wells in Central Wales (33%) also reported substantial year-on-year rises in uninsured convictions.

Kilmarnock (27%) recorded the largest annual increase in convictions in Scotland.

Bradford has the highest rate of uninsured drivers in 2023 so far

The latest DVSA FOI data for 2023, gave an insight into the areas that have the highest rate of motorists driving without insurance so far this year. This is subject to change when the full 2023 figures are released but suggests which areas may be close to the top come the end of the year.

Over 1,000 people have been caught without insurance in Bradford this year, one in 374 of all licence holders – the highest rate in the country.

| Postcode area | Rate of uninsured drivers in latest 2023 figures (e.g. one in X drivers have been convicted) |

| Bradford (BD) | 374 |

| Northampton (NN) | 418 |

| Ilford (IG) | 446 |

| Wakefield (WF) | 497 |

| Liverpool (L) | 507 |

| Oldham (OL) | 526 |

| Manchester (M) | 545 |

| Southall (UB) | 556 |

| Leeds (LS) | 557 |

| Leicester (LE) | 568 |

*Latest 2023 figures, subject to change when the final 2023 figures released

UK areas with lowest rate of uninsured drivers

Shrewsbury is the safest area in the country when it comes to driving with insurance, with a rate of one in 245, and followed by Harrogate with one in 203 drivers without insurance. Worryingly these are the only two areas in the UK that have a figure over 200, highlighting the extent of the problem faced in the UK with uninsured drivers.

Survey reveals nearly a quarter of drivers would consider driving without third party cover due to money concerns

Car insurance cover has risen by 61% in the last year1, and fears are intensifying that Brits may be tempted to risk driving uninsured to cut down on costs, with the average car insurance cover costing £561 per year2.

To find out the current mindset of UK drivers, we have surveyed 1,600 motorists to find out if they would risk driving without insurance due to the current cost of insurance.

Worryingly, nearly a quarter (24%) of drivers would consider driving without third party cover to save on costs with the hike in car insurance prices. This suggests the current number of uninsured driver convictions will continue an upwards trajectory with the current costs of driving.

Two thirds of drivers (63%) would never consider driving without third party cover, a statistic that is too low to ensure all motorists take care of themselves when taking to the road.

What are the consequences of driving without insurance?

Driving without insurance is illegal and therefore has its consequences. Although it will not appear on your criminal record, you will get six penalty points and a fixed penalty of £300 when caught driving a vehicle which you are not insured to drive3. An IN10 offence will be placed on your license and remain for four years.

However, if the case ends up in court, there is the possibility for an unlimited fine and disqualification from driving altogether.

Police also have the power to seize and sometimes destroy a vehicle being driven without insurance.

Other consequences include having a higher insurance premium for a number of years and if you have an accident while driving uninsured, the cost associated with the incident.

What to do if I am involved in an accident with an uninsured driver?

Our research has shown that there is a clear problem of drivers taking to the roads without insurance, putting other motorists at significant risk.

Having discussed the consequences to the driver, Here is what you should you do if you are involved in an accident with someone driving uninsured:

- Take down as much information as possible including date and time, the vehicles registration, make, model and other details such as its colour

- See if there are any witnesses and get their information to get their account on the incident

- Take photos and videos where possible.

- Obtain the details of the other driver, if they refuse or are uninsured, you need to contact the police.

It can be a much trickier process when claiming against an uninsured driver but is still possible when people have fully comprehensive car insurance.

To give yourself the best chance gather all the necessary details and give evidence of what happened including witness accounts and dashcam footage.

Those who don’t have fully comprehensive insurance can submit an application through the MIB who offer compensation for claims against uninsured or untraceable drivers.

Our Conclusions

The research we have conducted is deeply alarming, with thousands of drivers risking substantial fines and disqualification, but more importantly they are risking financial strife for those who could potentially be involved in a road accident with them.

Worryingly, financial struggles and the rising cost of car insurance is likely to see these figures increase in the coming years, with nearly a quarter (24%) of drivers we surveyed considering driving without third party cover due to money worries.

We urge drivers and companies to ensure they have the correct car and motor fleet insurance, and shop around for the best deals, to avoid making a decision that they will regret.

Sources & Methodology

- FOI Data received from the DVSA from 2019-2023 of the number of drivers with the IN10 code applied to their licence in each postcode area of the UK.

- FOI data received from each police force in the UK, requesting information on the number of drivers convicted in each postcode area of the UK.

- Rate of uninsured drivers’ statistics calculated by dividing the number of licence holders in each postcode area by the number of licences with an IN10 (driving without insurance code) applied.

- A survey of 1,637 UK drivers, conducted in December 2023.

1 https://www.moneysavingexpert.com/insurance/car-insurance/how-to-get-cheap-car-insurance/

2 https://www.abi.org.uk/news/news-articles/2023/11/record-motor-insurance-payouts–q3/

3 https://www.police.uk/advice/advice-and-information/rs/road-safety/driving-without-insurance

Read more on iCompario

Partially Pumped Up: Our Survey Reveals Many UK Drivers Can’t Afford to Fill Their Car with a Full Tank of Petrol

Study reveals almost half of commuters had to borrow money to get to work in the last 12 months

Driver Distractions: What are the most common distractions for UK motorists when on the move?