Apply for a fuel card today

Take the hassle out of fuel card applications with iCompario. Since we launched in 2017, our experts have helped over 64,000 businesses in the UK apply for fuel cards. After completing the form, we recommend a number of card options tailored to match your criteria. Once you’ve selected your desired card, you can complete your application online with us in just a few clicks. When this is complete, the fuel card provider will reach out to confirm the application and explain next steps.

Compare fuel cards quickly and easily

Our fuel card comparison form is the best way to find the most suitable card for your business. We’re not tied to any specific station brand or fuel card type, so you can trust that we provide unbiased advice and clear comparisons. This way, you can make informed decisions and quickly compare fuel cards to save you both time and money. Start your fuel card comparison today and let us guide you to the perfect solution for your business.

3 reasons to get a fuel card with iCompario

Save time

We make things easy. With iCompario you can compare the best fuel cards for your business and apply online in one seamless journey.

Save money

We find you the biggest savings. Our recommended fuel cards could save you up to 10p per litre on business fuel!

Fuel cards for every business

We compare fuel cards for businesses of every shape and size, with cards covering 98% of UK postcodes.

Compare EV fuel cards

As the number of electric vehicles increases, so too does demand for electric vehicle fuel cards, but it can be difficult to know which option is best for your business. That’s where we come in! At iCompario, we do all the hard work for you, matching your business’ unique requirements to an EV fuel card that would most suit your needs.

EV charge cards work in much the same way as fuel cards, but let you recharge at charging points across the UK. Compare now to find the best card for your electric business vehicle.

Fuel card comparison

As the largest fuel card comparison site, we’re experts when it comes to simplifying the process of finding the perfect fuel card. Our unbiased comparisons of leading brands allow you to easily compare features, prices, and provider networks. What’s more, the cards we compare cover 86% of UK fuel stations, ensuring you’ll always have access to a wide range of fuelling options, no matter where you go.

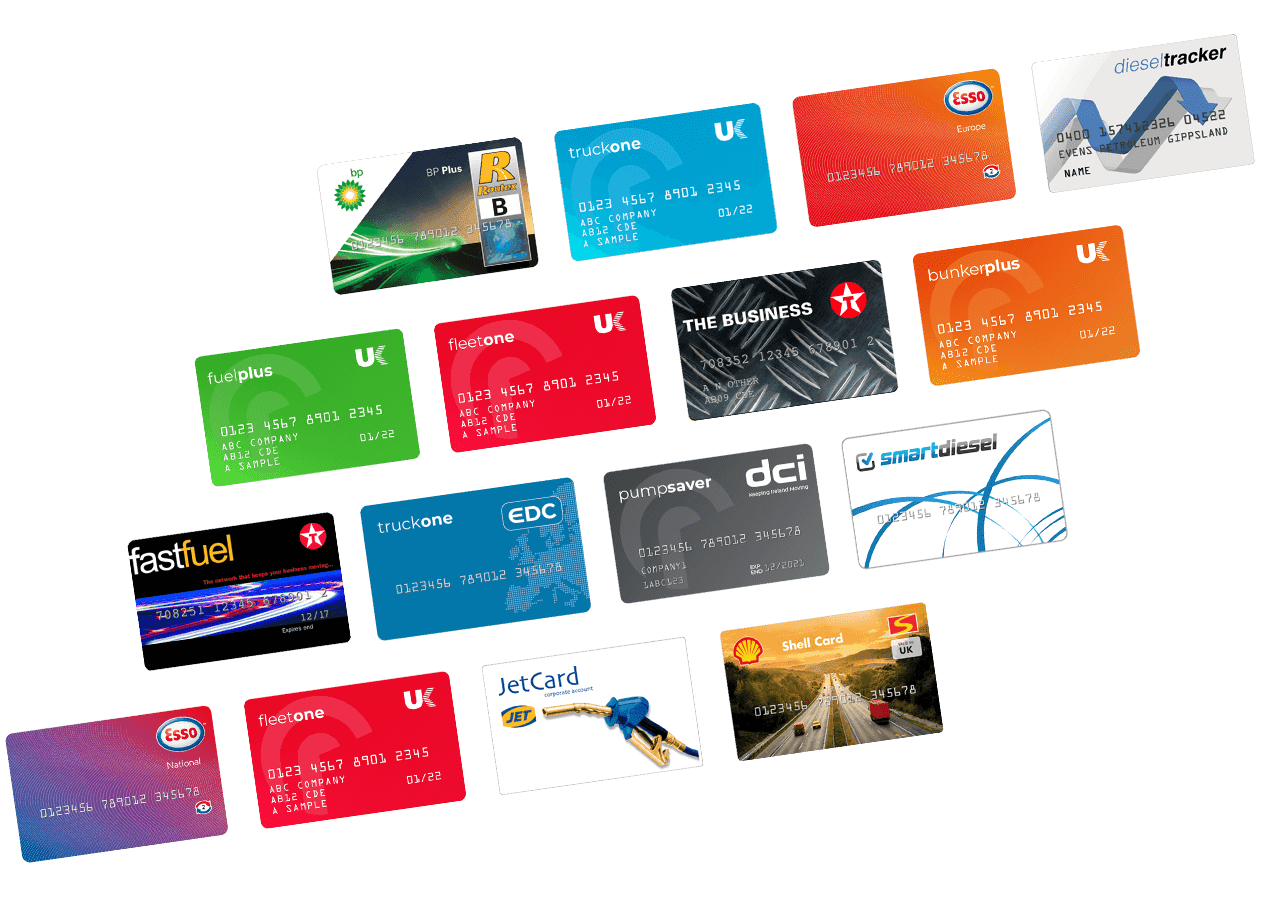

Here are the top fuel card brands available across the UK market.

How iCompario works

30-second fuel card form

Tell us about your business needs, number of vehicles, vehicle types and where you prefer to fill up with fuel.

We filter the offers

We’ll then compare fuel cards across the UK using our database that covers 98% of UK postcodes.

Find the perfect fuel card

After you’ve selected an option, we’ll deliver your fuel cards, allowing you to enjoy benefits such as savings of up to 10p per litre at thousands of UK fuel stations.

Find the best UK fuel card for your business

At iCompario, we understand that no two businesses are the same. Whether you’re a sole trader, SME or large enterprise, your business fuel card needs are unique, which is why we’re dedicated to providing a personalised service that puts you and your business’ needs first. Whether your goal is to simplify admin, increase security of fuel payments, or access price discounts, iCompario can help you find the ideal fuel card for your business.

Company car fuel cards

Fuel cards for company cars are the easiest way to manage company fuel expenses with full visibility of all transactions via an online account. When linked with telematics you can also split out business and personal use with ease.

Van driver fuel cards

As a van driver, you likely spend most of your time out on the road or attending jobs. Van fuel cards allow you to easily manage your fuel admin via itemised HMRC-compliant invoicing and automated direct debit payments.

HGV driver fuel cards

Tight delivery deadlines mean there’s no time to waste for HGV drivers. HGV fuel cards give you access to motorway fuel stations and truck stops with high-speed pumps to get you going again quickly.

Fleet fuel cards

Fleet fuel cards consolidate fuel expenses from multiple vehicles on to one single weekly invoice with one direct debit payment. Online reports can give you insights in to fuel spend by driver, vehicle, date and location.

Sole trader fuel cards

Fuel cards for sole traders and the self-employed provide you with HMRC compliant fuel invoices via an online account for easy fuel management allowing you to spend less time on admin and more time doing your job.

European fuel cards

European fuel cards are an easy way for drivers to pay for fuel abroad with no need to carry foreign currency. They also allow you to pay for road tolls and give you access to a European VAT recovery service.

What are fuel cards and how do they work?

Fuel cards are a type of payment card used to purchase petrol, diesel and other fuels, as well as other vehicle related products. Instead of using cash or a company credit card, they’re a safer and more convenient way for businesses to manage their fuel. Discounts on fuel are also available with the choice between diesel fuel cards and petrol fuel cards

To find out more, head over to our guide on how fuel cards work or take a look at the benefits of fuel cards.

Frequently asked questions

We compare fuel cards that cover 98% of UK postcodes, spanning over 7,200 locations nationwide. Some cards also let you spend at stations in Europe.

At iCompario, we have over 35 years of experience in the industry and have helped over 64,000 businesses in that time, meaning our experts are extremely well-equipped when it comes to matching your business with a suitable card. To find out which is best for your business, complete our quick and easy 30 second online fuel card form. We’ll then send you tailored recommendations to suit your needs.

No. They’re just for travel expenses. Unlike credit cards, fuel card providers. usually set weekly or monthly payment times. Need more info? Check out the full differences between credit cards and fuel cards.

iCompario allows you to compare fuel cards from a wide range of leading providers, such as the Shell multi-network,BP Plus and Esso National who provide brand specific fuel discounts at their stations, as well as the likes of fuelGenie and FuelPlus which are great choices for those wanting to fill up at supermarkets