What is Professional Indemnity Insurance?

When professional people offer professional advice, they must have enough skill, knowledge and information to make that advice reasonably safe to give. If they give advice without the right knowledge behind it, they can be held liable for any loss or damage that results.

A professional indemnity insurance policy is designed to offer protection to professional people against potential claims. These could be for injury or loss resulting from their actions, advice or failure to carry out their professional duties.

For example,

- An investment consultant may give incorrect advice, resulting in financial loss to their client.

- A marketing agency may incorrectly print the client’s telephone number in a printed advert.

- A doctor could misdiagnose an illness leading to further illness or the death of the patient.

- An IT consultant who provides services to back up and store data for a client company may make a mistake that leads to the loss of commercially valuable data, or confidential data.

This page provides some of the basic information about indemnity insurance. It is only relevant if you are resident in the UK. Using the expertise of an insurance broker ensures policyholders fully understand the covers available and the policy in place. (Check the FCA website to make sure an insurance broker is registered.)

What can professional indemnity insurance cover?

Professional indemnity insurance is a specialised branch of liability insurance. There are no standard policy wordings.

Professional indemnity insurance is compulsory for many professions, either under statutes (as in the case of solicitors) or as a regulatory requirement (as in the case of insurance brokers and financial advisers).

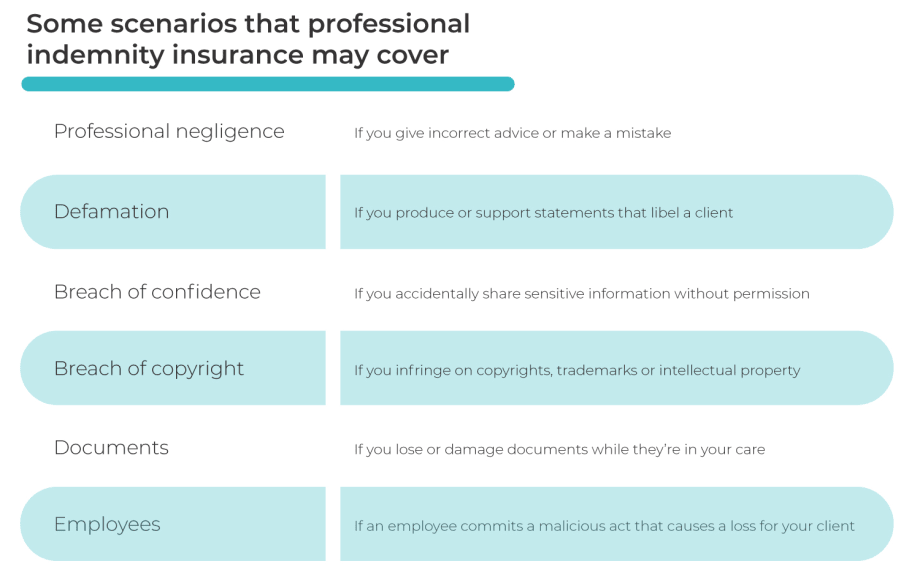

Policies cover liability for injury, damage or financial loss. This applies from a breach of professional duty carried out in good faith or negligent acts, errors or omissions in the professional capacity.

iCompario definition: What does that mean? It means the policy would cover your mistakes or carelessness while you were doing your job. It does would cover anything you did deliberately, knowing it would cause damage or harm.

People covered by the policy include the professional who is insured, plus any employees or partners and any agent.

Professional indemnity policies normally have an aggregate limit of indemnity including legal costs and expenses. This is the maximum you can claim under the policy in any one year. A limit of at least £1,000,000 usually applies, although you can ask for a higher limit. Some policies also have a limit on the value of any individual claim, including legal costs and expenses, called an ‘any one claim’ policy. Scroll down for more information on these two types of professional indemnity cover.

Professional indemnity cover is almost always provided on a ‘claims made’ basis. This means it does not matter when the act which led to the claim happened: what matters is when the claim is made. Provided the claim is made during the period of insurance, the policy will respond. Before giving you this insurance, many insurers ask you to write a declaration which describes any incidents which could potentially lead to a claim.

If you have never had professional indemnity cover before, insurers may impose a retroactive “cut-off” date. This means you cannot make a claim that derives from anything you did before that date.

Professional indemnity insurance specifically covers pure financial loss where there has been no injury or damage.

Lots of professional indemnity policies contain automatic extensions. These can cover libel and slander, loss of documents, costs of defending intellectual property rights, ombudsman’s awards and compensation for court appearances.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

What optional extensions to professional indemnity insurance are available?

You can choose optional extensions to a professional indemnity policy.

These include:

- Collateral warranties. These are common in the building trade. Put very simply, they cover sub-contractors’ work.

- Cover for any other person or firm acting jointly with you, the insured party.

- Continuation of cover beyond the date of cancellation in the event your firm closes down, which would set a period when claims could be made based on things you did before the closure of your firm.

- Liability for ‘breach of warranty of authority’, in case you take an action in good faith on behalf of a client which you are not actually authorised to do.

- Fidelity guarantee, which protects you against dishonest activities by an employee.

What exclusions are normally included in professional indemnity insurance?

If you take out professional indemnity insurance, there are very likely to be certain exclusions i.e. things that are not covered. These may include:

- A policy excess or deductible. This is the first part of a claim, typically £500

- Death, injury or illness of your employees

- Damage to third party property, unless it arises from your advice, design, specification or omission to perform one of your professional duties.

- Liquidated damages, which means a specified amount of damages agreed in advance relating to a specific situation. A non-refundable deposit is one example of liquidated damages.

- Circumstances which might give rise to a claim which you knew about before you took out the policy.

- Radioactive contamination.

- Pollution of any kind.

Who needs professional indemnity insurance?

Professional indemnity insurance used to be provided mostly for solicitors and accountants, whose job is almost all a question of giving advice. Recently is has become more popular among other professions, including other advisers and consultants in the computer industry, telecoms, education and healthcare.

Professional indemnity insurance is compulsory for many professions. This legal requirement is either under statute (as in the case of solicitors) or as a regulatory requirement (as in the case of insurance brokers and financial advisers).

It might be needed by a self-employed person or by a company doing certain types of work. Professions that often choose to buy professional indemnity insurance include the following examples, although this is not a complete list:

- Management and business consultants such as marketing consultants, training consultants and education consultants

- IT professionals including IT contractors, consultants, programmers and developers

- Technical and engineering contractors including CAD designers, project engineers and offshore oil and gas engineers

- Recruitment agencies and recruitment consultants

- Designers such as web designers, graphic designers and interior designers

- Fitness professionals including personal trainers, dance teachers and yoga instructors

- Teachers and tutors including private tutors.

Your registered insurance broker may recommend professional indemnity insurance if:

- You provide advice or professional services to your clients, including consulting or contracting

- You provide designs to your clients such as working as an architect or design engineer

- You want to protect against allegations of mistakes or negligence in work you have undertaken for your client

- You work as a contractor, consultant, freelancer or self-employed professional, and your client has asked you to arrange professional indemnity insurance before taking on a contract

- Your industry association or regulatory body says you must have it.

How would my premium for professional indemnity insurance be worked out?

When insurers set your premiums for professional indemnity insurance, they will consider various factors about your business.

The size and type of your business

Sometimes a premium “per capita” for each person the business employs is used. Bigger businesses generally have more at stake when it comes to financial and reputational losses. You’ll generally need higher levels of cover if you have a client that is a big company.

The value of the work or project you do

The premium for professional indemnity insurances may be rated on the gross fees, gross revenue or the amount of indemnity. Factoring in how much you’re being paid, and the overall value of your work can help you judge the appropriate level of cover.

The potential risk level of the work you do

The rate charged will vary between professions. If your business faces high levels of risk, then insurers are also likely to charge more in premiums. If you are working to a contract that requires you to have professional indemnity cover, it’ll usually specify the minimum amount of cover you need, and this will influence your premium.

Your previous claims record

The premium for your professional indemnity insurance, like any other type of insurance, will be influenced by your previous claims experience.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

What’s the difference between an ‘any one claim’ and an ‘aggregate’ policy?

‘Any one claim’ and ‘aggregate’ refer to the basis of cover on a professional indemnity policy.

- An ‘any one claim’ policy sets a maximum limit of the total value of every individual claim made in the period of the insurance policy.

- An ‘aggregate’ policy sets a maximum limit on the total value of all claims made in the period of the insurance policy.

For example, imagine you have an ‘any one claim’ professional indemnity policy that covers you for up to £600,000. You need make two claims in one year, each worth £400,000. Both of these claims are below the limit of £600,000 so your insurer would cover the costs of both claims.

Now imagine your policy has an aggregate limit of indemnity that covers you for up to £600,000. Again, you need to make two claims for £400,000 each. In total these make £800,000, but your insurance goes up to £600,000. In this scenario, your insurer would pay out £600,000 and you would not be covered for the remaining £200,000.

Although ‘any one claim’ is generally considered the more comprehensive option, the basis of cover varies from insurer to insurer depending on your business activity. It’s important you make sure you understand exactly what you are choosing.

What’s the difference between ‘claims made’ and ‘claims occurring’ policies?

A ‘claims made’ policy provides cover for claims which you notify to the insurer during the period you are insured with them.

If your policy is cancelled or not renewed, you cannot claim for things that occurred while you were covered. For this reason, it’s important to keep your professional indemnity insurance cover when you are between contracts or jobs.

This contrasts with a ‘claims occurring’ policy. A ‘claims occurring’ policy covers claims that occur during the policy period irrespective of when the claim is made. Professional indemnity policies are rarely, if ever, written on this basis, but this option is available for public liability and employer’s liability policies.

What is ‘run off’ cover?

Run off cover insures against claims of professional negligence brought against you after you are no longer running your business – either because you have sold it or because it has closed down.

It is particularly important for retired business owners to consider. If someone made a claim against them and they didn’t have ‘run off’ cover in place, they would have no insurance protection and would have to pay for their defence and damages liabilities out of their own pocket.

How can I choose or find a provider for Professional Indemnity Insurance?

Professional indemnity insurance is a specialised branch of liability insurance which is most commonly purchased as a stand-alone policy. Specialist schemes exist for some professions.

Cover is not offered by all insurers. Some composite insurers, as well as a number of specialist insurers and Lloyd’s syndicates, underwrite professional indemnity insurance. Cover is usually provided via a broker.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

Sources and further reading

For information on insurance and the insurance industry, visit The Chartered Insurance Institute.

To check of an insurance broker you are thinking of using is authorised and regulated in the UK , look them up on the The Financial Conduct Authorityregister.

For an overview of indemnity, see Wikipedia ‘Indemnity’.