What is public liability insurance?

We all have a legal duty to behave reasonably to other people, especially when going about our work. People who are not reasonable in their behaviour can be obliged to pay compensation to anyone they injure, or whose property they damage as a result of their actions.

If you become liable to another person, it means you owe them something. In the context of public liability insurance, if you are legally liable for injury or damage caused to a third party, it means you owe that person compensation. As a business owner:

- You could become liable to members of the public if you or your employees are careless or negligent.

- Liabilities can come about because of things wrong with premises where you work. Your public liability insurance documents are likely to call this “defects”.

- Liabilities can occur under certain acts of parliament in the UK.

This article looks at some aspects of public liability insurance.

Remember, this article is just an overview offering general information we are not advising you on which policies you should take out. It is also only relevant if you are in the UK. It doesn’t contain all the information you need to make your business insurance choices. If you’re in any doubt about your insurance requirements, you should discuss your business activities with a registered insurance broker to help you get all the cover that you need. (Check the FCA website to make sure any broker you are thinking of using is registered.)

Not a stand-alone insurance policy

Public liability insurance is not usually an individual policy. For most companies it is part of a policy which includes three covers on one:

- Public liability insurance

- Products liability insurance

- Employers’ liability insurance (not everyone needs this. You can find more details here).

Do I need public liability insurance?

If there is any chance a member of the public could be injured or have their property damaged as a result of work you do, then you might want to consider public liability insurance. This applies to any business activities that involve interacting with the pubic including customers, suppliers or passers-by and can occur working in public places, private homes or business premises

Some examples are:

- Plumbers

- Electricians

- Building contractors

- Cafes, restaurants and caterers

- Property owners, whether or not the property is rented out

Public liability insurance is not usually compulsory by law. However, a few types of businesses are controlled by specific laws, such as horse riding schools.

Some customers may insist that your business has public liability cover, as a condition of awarding you a contract. They may even ask for confirmation in writing that you do have cover.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

What does public liability insurance cover?

A public liability policy provides cover for damages you may be legally obliged to pay to third parties. These could be for accidental physical injury, death, disease or illness, and for any loss of property, or damage to property. You are only covered if these happen in connection with the business that is insured, during the period of insurance.

You could become legally liable in various ways. The most common is due to your negligence. Public liability insurance also covers nuisance, trespass and any liability set specifically by law.

Definition: Negligence, put very simply, means being careless or making a mistake. In the world of insurance, it means not doing what most reasonable people would do in the same situation, resulting in damage to property or harm to people. If a water pipe burst, would most people shut off the mains supply before doing anything else? That would be reasonable. If you left water gushing out of the pipe and damaging the walls and floor while you phoned around to find a plumber, that would be negligence.

The injury or damage suffered must be accidental, because public liability cover is only intended to cover unexpected events.

If the word ‘accidental’ is not specifically used in the description of what is covered in your policy, there is usually another section that explains exclusions: here it will state that injury or damage that you caused deliberately is not covered by the insurance.

The injury or damage must have been caused in connection with the trade or business stated in the policy wording. In other words, you are only insured for things that happen while you are doing your own job, but not while doing other things.

However, most public liability policies also include some activities that are “extras” to your main job. Some examples of these could include:

- First-aid facilities

- Canteens

- Private fire brigade services

- Private ambulance services

- Private work carried out for a director, partner or employee of the company.

Particular laws relevant to public liability insurance

A business may be considered negligent if it breaks certain laws designed to protect the public, and by doing that they incur a legal liability. They extend upon the principle of acting reasonably and not being negligent, by going into specific details.

They include the following laws:

The Defective Premises Act of 1972

Public liability insurance extends to cover any legal liability you may have for defects in premises that you have previously owned or occupied, as long as the insurance remains in force.

The Defective Premises Act 1972 imposes liabilities for up to seven years after you sell the property. This law deals with landlords’ and builders’ liability for poorly constructed and poorly maintained buildings, along with any injuries that may result. This makes it important protection for people who buy new-build homes, for example.

For example, if you don’t maintain your business premises in good order to keep it safe, and a visitor is injured while there, they could make a claim against you. This could be slipping on a broken step, for example, cutting themselves on a broken window or getting electrocuted by a loose wire.

This law is very important for landlords.

The Consumer Protection Act of 1987

This law allows consumers to claim compensation if a defective product has caused personal injury, damage to property, or death.

It is a highly important law in the UK that governs any goods bought by the public. Public liability insurance covers legal costs and expenses in defending prosecutions under this legislation.

The Food Safety Act of 1990

This act of parliament created the Food Standards Agency. This agency makes sure businesses do not include anything in food, remove anything from food or treat food in any way which means it would be damaging to the health of people eating it. It also makes sure the food businesses serve or sell is of the nature, substance or quality which consumers would expect. Finally, it makes sure that the food is labelled, advertised and presented in a way that is not false or misleading.

Some violations of this law would include selling contaminated food, giving people food poisoning, selling them food containing ingredients they are allergic to and putting dangerous additives in food.

Public liability insurance covers legal costs and expenses in defending prosecutions under this legislation.

What compensation can public liability insurance pay for?

Public liability insurance covers the cost of compensation to third parties for death, injury or damage to their property, which happens as a result of a firm’s business activities. Financial loss is covered too, but only if it is the direct result of accidents that injure people or damage property. This might include:

- loss of earnings

- possible loss of future earnings

- medical bills

- legal fees

- hire costs

- compensation payments for pain and suffering

Definition: A ‘third party’ is anyone outside the company that the business has contact with, for example, people visiting the premises, watching activities that the business has organised, customers, suppliers and even passers-by.

Public liability insurance can also include cover for the following items:

- The affected person’s costs and expenses associated with a claim.

- Your legal costs, whether you are legally liable or not. The cost of taking legal advice and defending yourself in court can be high, and your insurance would usually cover it.

Your legal costs and expenses in defending prosecutions under specific laws. These might be health and safety legislation, the Consumer Protection Act of 1987 and the Food Safety Act of 1990.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

What is usually included and excluded in public liability insurance?

There is a maximum payout amount set in public liability insurance policies. This is called a ‘limit of indemnity’.

The amount can be anything from a small sum to many millions. It is set in relation to any one event. You can arrange to have this limit set higher depending on what is appropriate to your particular business activities.

Payouts can cover:

- Financial losses that are a direct result of injury to people or damage to their property. For example, if a sign falls off a shop and ruins someone’s car, the shop owner’s public liability policy would cover the cost of repairing the vehicle. Hiring another car while the repairs were being done would also be covered.

- Loss or damage to premises rented or hired by yourself.

- Legal liability for anything wrong with premises that you previously occupied or owned, whilst your insurance remains in force. This is because of the Defective Premises Act of 1972 which says you are responsible for defects in buildings you have owned for up to seven years after you sell them. If you allow your insurance to lapse, then you cannot claim for things that you did in the past as the policy is normally on a “claims occurring” basis – meaning the policy needs to be in force at the point a claim is made.

What optional extensions to public liability insurance are available?

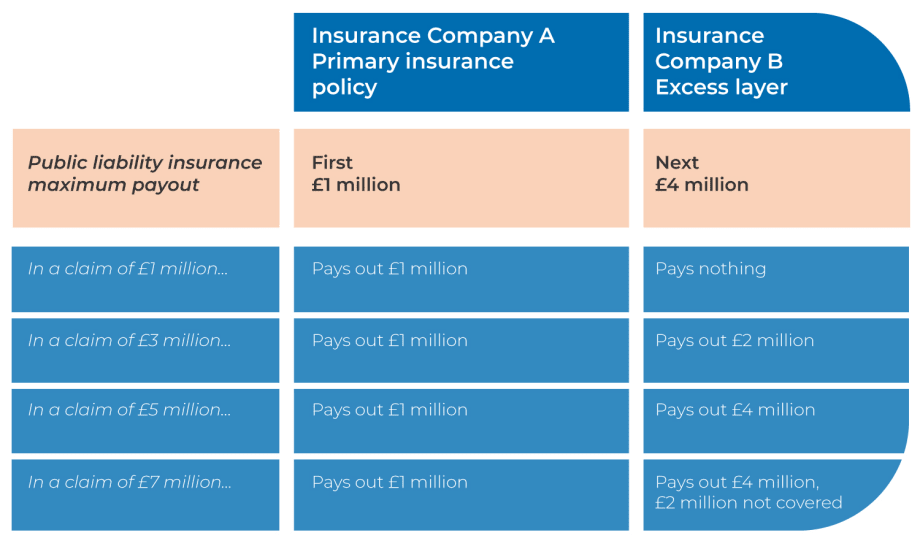

The most widely used optional extension is to increase the limit of indemnity. If this cannot be provided by your existing insurer, you purchase an additional policy from a different insurer, which is called an “excess layer”. You can have more than one excess layer.

Example

What are the important exclusions from public liability insurance policies?

Public liability insurance policies exclude various types of risk which are covered by another type of policy. These are listed in the table below.

What affects the price that you pay for public liability insurance?

The price of public liability policies is usually based on

- the revenue / turnover of your business

- the limit of indemnity that you need

- your trade, business or profession.

Sometimes the price is a flat rate if the risk relates only to activities at your work premises.

How to get the right public liability insurance

Most insurers offer public liability insurance as part of a bundled Employers’, public and products liability insurance policy.

If you are uncertain about the level of cover you should have, an insurance broker can offer advice and get a quotation that matches your circumstances, and what you need.

iCompario tip:

To get the right combination of insurance, iCompario recommends that you use a broker registered with the Financial Conduct Authority (FCA) for business insurance, instead of trying to choose for yourself.

About this website

iCompario is the free online marketplace for business products and services, where managers and owners can research and rapidly compare fuel cards, vehicle tracking systems, insurance, telecoms and other essentials. We follow up each online query by telephone, to make sure every site visitor finds their ideal, future-proof product at the best price possible.

iCompario is an IAR or Introducer Appointed Representative of business insurance broker Joseph W. Burley and Partners (UK) Ltd. which is registered with the Financial Conduct Authority.

Sources and further reading

For information on insurance and the insurance industry, visit The Chartered Insurance Institute.

To check of an insurance broker you are thinking of using is legally registered, look them up on the The Financial Conduct Authority website.

Find out more about the UK Defective Premises Act of 1972 on Wikipedia or on the UK government website.

Find out more about the UK Consumer Protection Act of 1987 on the website of the Consumer Protection Association. The act allows consumers to claim compensation if a defective product has caused personal injury, damage to property or death.

You can also read about the UK Consumer Protection Act of 1987 on Wikipedia or on the UK government website.

Find out more about the UK Food Safety Act of 1990 on the Food Standards Agency website, which was created by the act.

You can also read about the UK Food Safety Act of 1990 on Wikipedia.

Health and Safety Executive information on Public liability insurance